Payroll management has experienced a substantial transition as the digital era continues to transform all facets of business operations.

Gone are the days of unending paperwork, manual calculations, and delayed payroll processing.

Modern payroll software solutions have made it possible for Canadian firms to streamline their payroll processes with quick, accurate, and user-friendly tools.

In this comprehensive guide, I will unravel the top 10 best payroll software in Canada based on features, integration, pricing, and pros and cons.

I will also provide you with valuable insights to help you make informed decisions for your business.

From automating calculations and deductions to managing employee records and generating tax forms, the best payroll software in Canada offers a plethora of features designed to simplify your payroll management tasks.

Before selecting the best payroll software in Canada, there are some criteria I kept in mind;

Criteria for Selecting the Best Payroll Software in Canada

With a lot of payroll software on the internet, it is very easy to fall into the wrong hands which is why I took the following criteria very important in the selection process;

- User interface (UI): The user interface is one of the most important criteria for selecting the best payroll software in Canada so I made sure to select payroll software systems that are well-organized visually and easy to navigate.

- Integrations: Another factor I kept in mind while selecting the best payroll software in Canada is integration.

The selected software in this article enhances productivity by providing features that seamlessly integrate with various systems such as time tracking, invoicing, direct deposit, and mobile applications, among others. - Pricing: Another key factor I put into consideration is pricing and the value for money. The goal isn’t to provide you with software that will break your pocket so I was careful to select software that is affordable and effective.

- Customer support: Customer support is another important factor when it comes to picking the best payroll software in Canada so I was careful to select software that provides customer support in case you have any difficulties using the software.

Now let’s dive in and unravel the best payroll software in Canada.

10 best Canadian payroll software

In no particular order, here is the list of the best payroll software in Canada;

Here is a brief summary of each of the payroll software in Canadian, along with examples of its best use cases, a list of its standout features, and pricing.

1. Wagepoint

The first software on our list of the best payroll software in Canada is Wagepoint. Wagepoint is a cloud-based payroll software designed specifically for small businesses.

The software was founded in 2012, and it offers several features to help small businesses such as direct deposit, tax calculations, and integration with popular accounting systems. It ensures compliance with tax rates and regulations, making it a reliable choice for businesses of all sizes.

Key Features:

- Wagepoint offers a user-friendly interface, making payroll processing quick and straightforward.

- It handles various payroll tasks, including direct deposit, tax calculations, and year-end reporting.

- The software keeps up-to regulations-date with tax rates and, ensures compliance.

- It integrates with popular accounting systems, such as QuickBooks and Xero.

Integration:

- Seamless integration with accounting software also streamlines the flow of data between payroll and accounting processes, reducing manual data entry.

Pricing:

- Wagepoint offers pricing plans based on the number of employees and the frequency of payroll runs. Prices start at $20 per month, with an additional feature that enables pay-per-employee fees.

Pros:

- Easy to setup and use

- Affordable

- Excellent customer support

- Dedicated Employee Portal

Cons:

- It lacks the advanced features required by larger businesses.

- No mobile app

- Wagepoint doesn’t come with a built-in employee time-tracking application.

2. Ceridian Dayforce

The next on our list is Ceridian Dayforce. Ceridian Dayforce stands out as a leading provider of Human Capital Management (HCM) solutions, renowned for its team of internal compliance experts who diligently stay up-to-date with regulatory changes.

By entrusting Ceridian with day-to-day benefits administration and payroll responsibilities, businesses can free up valuable time to concentrate on other essential tasks. This payroll software solution is particularly advantageous for Canadian companies with aspirations of expanding internationally, as Ceridian facilitates payroll delivery in over 160 countries.

Simplifying the payroll process and ensuring heightened accuracy through real-time calculations, Ceridian’s integrated pay and time engine is a game-changer.

Additionally, the software handles tax management and filing on behalf of the company, seamlessly aligning with both provincial and federal regulations. To further enhance convenience, employees have direct access to their pay stubs and tax information through the self-serve feature provided by Ceridian.

Key Features:

- Ceridian Dayforce is a comprehensive payroll and workforce management solution.

- It offers payroll processing, tax compliance, time and attendance tracking, and HR management features.

- The software provides real-time analytics and reporting for better workforce management decisions.

- It enables employee self-service tools that enable employees to view pay stubs, manage direct deposits, and submit time-off requests.

Integration:

- Ceridian Dayforce integrates with various HR and financial systems including CIBC SmartBanking for Business and QuickBooks, allowing seamless data flow and reducing manual data entry.

Pricing:

- Pricing information for Ceridian Dayforce is available upon request, and it is typically tailored to the specific needs and size of each organization.

Pros:

- Easy-to-use platform

- Reliable in-house compliance support

- It has a mobile app

- It has real-time analytics for better decision-making.

- It enables employee self-service tools to improve organizations’ efficiency.

Cons:

- Pricing details may not be readily available.

- Some mobile app limitations

3. QuickBooks

The third payroll software on the list is Quickbooks. QuickBooks Payroll is a popular add-on to QuickBooks Online, allowing businesses to manage and run payroll seamlessly from their computer or mobile device.

With integration into the existing QuickBooks system, it offers a comprehensive solution for financial and payroll management. The software includes HR management functions within the payroll module, enabling tasks such as employee onboarding and benefits administration.

Ideal for businesses already using QuickBooks Online for bookkeeping, QuickBooks Payroll streamlines payroll processing, reduces errors and provides a user-friendly interface. Its accessibility from anywhere ensures flexibility, making it a convenient choice for businesses on the go.

Key Features:

- QuickBooks Online Payroll is an add-on service for QuickBooks Online accounting software.

- It provides comprehensive payroll functionality, including pay runs, tax calculations, and payroll tax filings.

- The software supports direct deposit, electronic pay stubs, and year-end reporting.

- It offers employee self-service features, allowing employees to access their pay stubs and tax documents.

Integration:

- QuickBooks Online Payroll seamlessly integrates with QuickBooks Online, ensuring smooth data flow between payroll and accounting processes.

Pricing:

QuickBooks has three pricing plans;

- Simple Start: $9.00 per month (one user)

- Essentials: $13.50 per month (three users)

- Plus Plan: $19 per month (five users)

Pros:

- Straightforward Payroll

- Compatible mobile app

- It has employee self-service features which improve convenience.

- Automated tax calculations and filings.

Cons:

- Most features are tailored for US businesses

- It might not be the best option if you’re not using QuickBooks already

4. Rise

Next up, we have Rise. Rise is a Canadian payroll software that prioritizes compliance to ensure accurate and timely tax payments for businesses of all sizes. Designed with small business owners and large enterprises in mind, Rise ensures adherence to both provincial and federal regulations.

One of the best parts of this software is that if you’re transitioning from another payroll provider, Rise takes care of communication with the CRA and government agencies to ensure a smooth switch without errors.

Offering flexibility as a standard feature, Rise allows users to customize payroll processes by running it multiple times, canceling pay runs, making off-cycle payments, and even calculating tax-free bonuses. The software also includes an automatic tax remittance feature that complies with Canadian regulations.

Key Features:

- Payroll and HR software with a focus on time and attendance tracking.

- Features for managing employee schedules, clock-ins, and time-off requests.

- Handles payroll calculations, tax deductions, and statutory compliance.

Integration:

- It can be integrated with Freshbooks, Intuit Quickbooks, WealthSimple, and Xero.

Pricing:

- Start plan: $6.00 per month (one employee).

- Grow plan: Contact the sales team for more details.

- Optimized plan: Contact the sales team for more details.

Pros:

- Efficient time and attendance tracking for improved workforce management.

- Cost-effective

- Responsive support staff

Cons:

- It may lack some advanced payroll features.

- Pricing plans are not transparent.

5. Xero

Designed specifically for current Xero users, the Xero Payroll add-on offers a straightforward payroll solution that meets the needs of small business teams with simple payroll requirements.

While larger teams with more complex payrolls may need to integrate a third-party app, Xero ensures that small Canadian businesses with a limited number of employees have access to all the necessary functionality within their platform.

With the Xero Payroll option, users can manually input vacation leave, hourly rates, hours worked, and taxes, and easily calculate deductions. For recurring pay runs, the ability to duplicate a previous run and make necessary adjustments simplifies the process while ensuring accuracy. Furthermore, Xero enables the convenient distribution of pay stubs through email or direct printing, providing an efficient and user-friendly payroll experience.

Key Features:

- It can be integrated with other payroll functions within the Xero accounting software.

- It handles payroll processing, tax calculations, and payroll tax filings.

- It supports direct deposit, electronic pay stubs, and year-end reporting.

- Employee self-service features for accessing pay stubs and tax documents.

Integration:

- Seamlessly integrates with Capsule CRM, DEAR Inventory, Deputy, Expensify, EzzyBills, HubSpot, Tradify, and WorkflowMax.

Pricing:

- It has different pricing plans based on the number of employees and the level of service required. However, the pricing plans start at $17 per month.

Pros:

- It has a lengthy list of integrations

- Mobile app available

- Simple and straightforward functionality

- Existing Xero users can run payroll from within this familiar tool

Cons:

- Does not accommodate larger teams

- Exclusively available within Xero

- It has customization options that may be limited compared to standalone payroll software.

6. Knit

Knit is the go-to payroll software for Canadian business owners in need of a quick setup. This cloud-based tool ensures easy adoption and ensures accurate payroll processing right from day one. With a simple click, users can calculate payroll and remit taxes to the CRA based on their specific scheduling requirements.

Knit offers a range of additional features, including generating ROEs and employee reports, addressing EHTs and WSIB, and storing T4s for self-serve employee access. Pay cheques can be conveniently deposited directly into employee bank accounts. For businesses requiring extra support, Knit provides a team of Canadian payroll experts to assist with payroll management or handle it entirely on your behalf.

Key Features:

- It has comprehensive payroll software with a user-friendly interface.

- It handles payroll processing, tax deductions, and year-end reporting.

- It enables an employee self-service portal for accessing pay stubs and tax documents.

- It can be integrated with popular accounting systems and HR tools.

Integration:

- It enables seamless integration with QuickBooks Online, TSheets, and Xero.

Pricing:

- It has customized pricing based on company size and requirements. However, pricing starts at $43 per month

Pros:

- It has an intuitive and user-friendly interface.

- Free 30 days trial.

- The support team can take over payroll management on your behalf.

- It can integrate with accounting and HR tools.

Cons:

- Its pricing details are not transparent.

- Better suited to desktop than mobile app use

7. ADP Workforce Now

ADP Workforce Now is a comprehensive cloud-based platform that combines various functionalities, including time tracking, benefits management, HR, talent management, and payroll management.

With a single dashboard, businesses can efficiently manage their entire workforce without the need to switch between multiple platforms. This integrated solution saves time and enhances productivity. ADP Workforce Now prioritizes data security with enterprise-grade measures and comprehensive privacy practices.

The platform minimizes manual data entry through real-time data pre-population across workflows, reducing errors and ensuring accurate payroll processing. Proactive error detection features send alerts to prevent mistakes, enabling businesses to focus on more critical tasks.

Key Features:

- It has comprehensive payroll services tailored to the needs of Canadian businesses.

- It handles payroll processing, tax calculations, and remittances.

- It offers customizable reporting options.

- It provides expert guidance on compliance with payroll-related regulations.

Integration:

- ADP Workforce Now offers integration with accounting software like QuickBooks, Wave, and Xero, as well as ERPs such as Oracle, SAP, and Workday. It also integrates with time and attendance solutions like Clock Shark, Deputy, and Dolce, and recruiting/onboarding solutions such as GoodHire, Sapling, and Zip Recruiter.

Pricing:

- It has customized pricing based on the scope of services required.

Pros:

- It has an extensive list of integrations

- A comprehensive mobile app

- It requires expert guidance on payroll compliance with CRA.

- It offers flexible customizable reporting options.

Cons:

- The pricing is not transparent.

- There is no free trial available

8. Humi

Humi is a comprehensive cloud-based platform that encompasses HR, payroll, and benefits management.

With a strong focus on HR management tools, Humi offers a robust suite of features, including an employee portal, time tracking, performance management, employee onboarding, and recruitment tools. These tools empower small and medium-sized companies to streamline and automate essential HR tasks.

While primarily an HR platform, Humi also offers a payroll module. User reviews highlight the software’s clean and user-friendly interface, reflecting Humi’s efforts to create an intuitive payroll process. However, it’s important to note that Humi’s payroll functionalities are relatively basic and suitable for straightforward payroll needs.

Key Features:

- It has a comprehensive HR and payroll platform designed for Canadian businesses.

- It handles payroll processing, tax deductions, and remittances.

- It offers additional HR features, including employee onboarding and performance management.

- It has an employee self-service portal for accessing pay stubs and tax documents.

Integration:

- It can be integrated with popular accounting systems including Greenhouse, Voila, Workable, Xero, and Zapier.

Pricing:

- It has customized pricing based on company size and requirements.

Pros:

- All-in-one HR and payroll solution.

- Easy tracking of all employees.

- A free demo account is available upon signing up.

- It has a user-friendly interface and additional HR features.

- It can be integrated with almost all accounting and HR tools.

Cons:

- It has pricing details that may require consultation.

- Some advanced features may be limited compared to larger HR and payroll software providers.

9. Deel

Deel is a comprehensive global HR solution with advanced payroll features designed for companies operating worldwide. With the capability to run payroll in over 90 countries, including Canada, Deel streamlines operations and addresses challenges associated with taxes, local compliance, and benefits management.

Deel’s payroll software specifically caters to Canadian businesses, ensuring compliance with relevant Canadian regulations. By leveraging Deel, companies can alleviate concerns regarding taxes, compliance, government declarations, and calculations as the software handles these tasks.

One of the factors that set Deel apart is its impressive efficiency in onboarding teams. Companies can have their entire team up and running with Deel within just a month, a process that often takes much longer with other payroll providers.

Key Features:

- User-friendly payroll software with a focus on simplicity and ease of use.

- Deel’s in-house payroll team processes payroll directly and provides end users with support to resolve any issues within your payroll process.

- It provides employee self-service features for accessing pay stubs and tax documents.

- Deel can help you offer localized benefits for staff based within Canada or any other location they support.

Integration:

- Its integration includes Ashby, BambooHR, Expensify, Greenhouse, Hibob, Netsuite, Okta, OneLogin, Quickbooks, SCIM, Xero, Workday, and Workable.

Pricing:

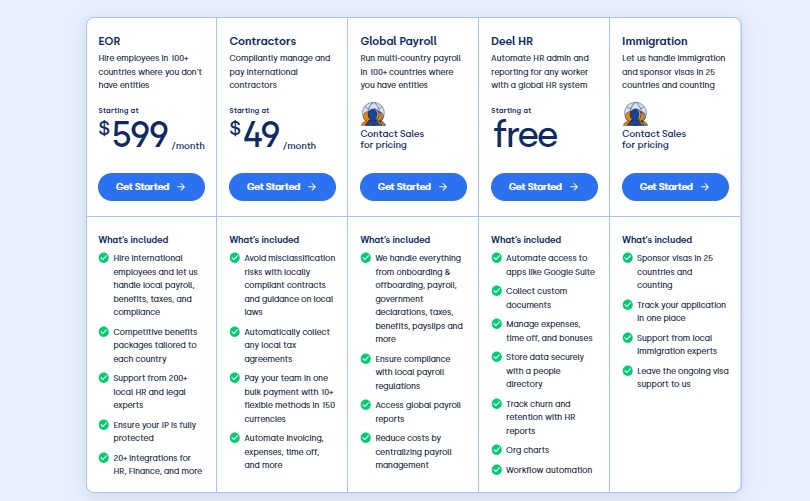

- It has customized pricing based on the country you are in, and the company size. Below is an image of their pricing plans and what they have to offer;

Pros:

- It is simple with a user-friendly interface.

- It has efficient payroll calculations and tax deductions.

- Flat rate pricing with no hidden fees

- It has customizable reporting options.

- Add-ons available to localized benefits and global payroll

Cons:

- Pricing is a little high for small businesses

- Integration capabilities may vary depending on the specific requirements.

10. Papaya Global

And the last software on our list of the best payroll software inj Canada is Papaya Global. Papaya Global is a global payroll platform that offers smart and streamlined payroll solutions for companies worldwide, including those in Canada.

With support for over 160 countries, Papaya Global’s platform encompasses payroll, compliance, benefits, and HR features tailored for global businesses. By utilizing this solution, Canadian companies can ensure compliance with local regulations, including SOC2 requirements.

Papaya Global provides Canadian businesses with a robust payroll solution that meets their local payroll needs while also enabling the hiring of talent abroad. This allows companies to expand their global workforce while remaining compliant with relevant regulations.

With quick onboarding for new customers, the platform provides 360-degree visibility into workforce spending, leading to increased productivity and performance for businesses utilizing their solutions.

Key Features:

- It has numerous automation for payroll calculations, tax filing, compliance, equities, and time and attendance tracking.

- It supports payroll processing for over 160 countries

- Integration with a variety of HR and accounting software

- Self-service employee portal

- Compliance with all applicable regulations

Integration:

- It is integrated with most financial tools, as well as with BambooHR, Expensify, NetSuite, SAP SuccessFactors, and Workday

Pricing:

- The pricing of payroll software varies depending on the provider and the features offered. However, most providers offer a variety of pricing plans to fit the needs of businesses of all sizes. Click here for more details: Papaya Global Pricing

Pros:

- It can handle diverse legal requirements across nations.

- User-friendly payroll software with a focus on simplicity and ease of use.

- Real-time reporting and analytics.

- A mobile app is available.

Cons:

- Integration capabilities may vary depending on the specific requirements.

FAQs

What are the different types of deductions that can be made from an employee’s pay in Canada?

The deductions to be made are typically mandatory and they include income tax, Canada Pension Plan (CPP) contributions, and employment insurance (EI) premiums.

What is the Canada Pension Plan (CPP)?

The CPP is a contributory, earnings-related pension plan that provides income to retired or disabled individuals and their survivors. Both employees and employers contribute to the CPP, and the deductions are remitted to the Canada Revenue Agency (CRA).

What is the Employment Insurance (EI) program?

Employment Insurance provides temporary income support to individuals who are out of work due to reasons such as layoff, illness, or maternity leave. Employers deduct the employee’s portion from their wages and remit it to the CRA.

What is the Employer Health Tax (EHT)?

Employer Health Tax is a little amount of money deducted from employees’ payment, in order to cater for sick and retired workers.

What are the key components of the Canadian payroll system?

The key components include payroll calculations, tax deductions, remittances to government agencies, record-keeping, reporting, and compliance with federal and provincial regulations.

Conclusion on the Best Payroll Software in Canada

The Canadian market offers a wide range of excellent payroll software solutions to cater to businesses of all sizes and needs. In this article, we have explored the top 10 payroll software in Canada, each offering unique features and benefits.

From the comprehensive capabilities of leading software providers like ADP Workforce Now and Ceridian Dayforce to the user-friendly interfaces of Rise and Humi, Canadian businesses now have access to powerful tools that can simplify and streamline their payroll management processes.

Whether you are a small business owner seeking simplicity or a larger enterprise with complex payroll requirements, the payroll software in Canada reviewed in this article can help scale up your business with accurate and compliant payroll operations.

Before picking software, consider the specific needs of your organization, such as scalability, regulatory compliance, user-friendliness, and integration capabilities.